MOTODYNAMICS – 2023 Nine-month Results

Motodynamics Group continues the course it has charted in recent years with significant growth in all figures for the 01.01 – 30.09.2023 nine-month period.

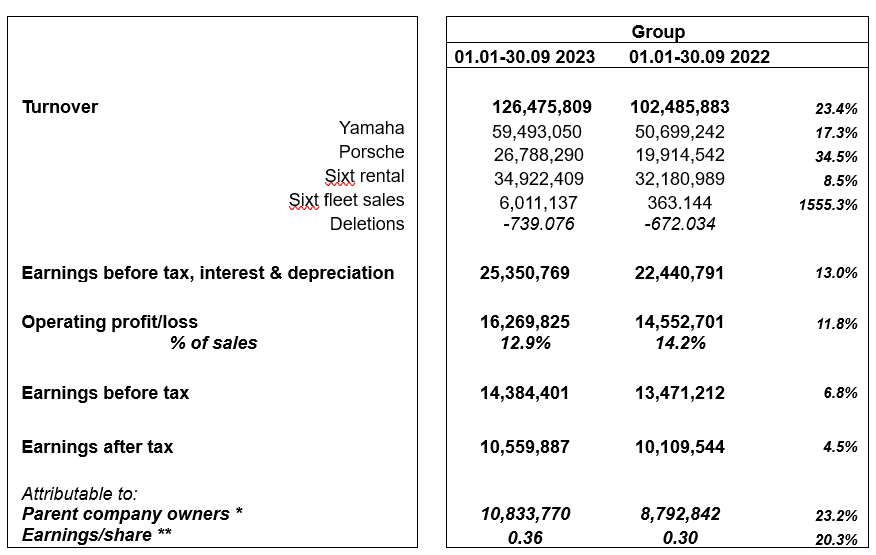

Sales grew by 23.4% compared to the corresponding period of 2022 and amounted to EUR 126.5 million. Earnings before tax, interest & depreciation (EBITDA) amounted to EUR 25.4 million, increased by 13%, while the results before tax amounted to EUR 10.8 million and grew by 23.2% compared to 2022. Earnings per share amounted to EUR 0.36 from EUR 0.30 for the corresponding 2022 period.

* in 2023 the minority rights refer to the 01.01 – 25.05.2023 period

** total shares exclude the company’s own shares

All individual business activities contributed to the Group’s profitable growth: Yamaha sales (motorcycles & marine products in Greece, Romania and Bulgaria) amounted to EUR 59.5 million (+17.3%). Porsche sales amounted to EUR 26.8 million (+34.5%). Sixt’s income from car rentals rose to EUR 34.9 million (+8.5%) and car sales amounted to EUR 6 million.

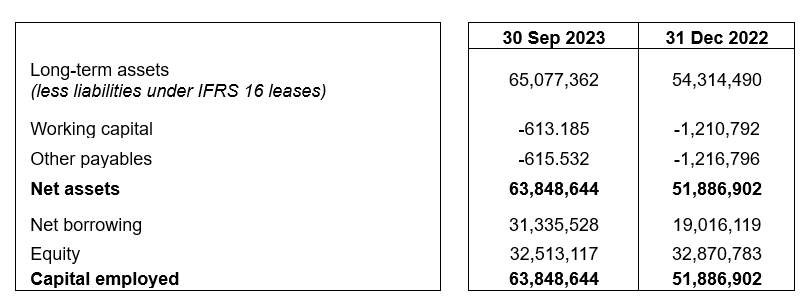

In the nine months of 2023, the Group’s long-term assets (excluding the effect of IFRS 16) amounted to EUR 65.1 million, recording an increase of 19.8% compared to 2022. This increase is mainly due to investments in the SIXT fleet.

The Group’s positive operating cash flows entirely financed the purchase price for the minority shares of the subsidiary Lyon Rental amounting to EUR 7.7 million and contributed to the financing of Sixt’s fleet growth, with the remaining part of the investment coming from loans. The Group’s net borrowing amounted to EUR 31.3 million, increased by EUR 12.3 million compared to 2022.

Paris Kyriakopoulos, Chairman & Managing Director, stated the following:

“Motodynamics had a very strong nine-month period, with significant growth in sales and profitability across all our businesses. After the record year of 2022, all our teams set offensive targets for 2023. In both Yamaha and Porsche, the business cycle is growing at a high double-digit rate: +17.3% and +34.5 % respectively. This performance is due to the dynamic growth of individual markets in which we operate, the general normalization of the supply chain, but also to specific actions that led to the recovery of market share.

Car rentals keep up with the significant upward trend of recent years, with inbound tourism following an excellent course and tourist arrivals significantly exceeding those of 2019. Profitability of the business is returning to normal and remains very healthy. Revenues from car rentals for the nine-month period increased by 8.5%, with increased bookings, but also a reduced average price compared to 2022. Sales of fixed assets were also particularly high, with the team taking advantage of the good market conditions for used cars and with targeted actions, recording significant gross profitability. Following the completion of the acquisition of the minority stake in Lion Rental, we continue to invest in this business based on our medium-term plan.

Our individual markets continue to grow at a significant pace, while we also see the first signs of a decline in inflation. We expect to close 2023 significantly above 2022 and with a record in all our figures. The highly volatile geopolitical and geoeconomic environment remains the main risk we monitor, and we are always ready to react to substantial changes in the demand for our products and services. »

MOTODYNAMIKI Group organizes an online Analysts’ Briefing on the “Overview of 2023 nine-month period Results”, on Wednesday, November 1, 2023, at 16:00 through the Zoom webinar platform and with the support of ATHEX.

The briefing will be carried out by Paris Kyriakopoulos, Chairman and CEO, and Dimitris Bozas, Chief Financial Officer.

You can follow the link below to register and participate: