MOTODYNAMICS closes another record year of strong and profitable growth posting a 29% increase in sales and 28% increase in Earning Per Share

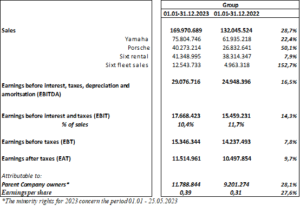

Motodynamics continues the path it has forged in recent years with significant growth across all financial metrics for 2023. For the Fiscal Year 2023, sales increased by 28.7% and amounted to €170 million. Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA) increased by 16.5% to 29.1 million euros, while post-tax profits attributable to parent company owners increased by 28.1% to €11.8 million.

Earnings per share (EPS) amounted to 0.39 euros from 0.31 euros in 2022. The growth in EPS is attributable both to the annual growth in profits for the company and to the successful completion of the acquisition of the minority interests in Lion Rental S.A. (SIXT).

The Board of Directors will propose to the General Meeting of Shareholders a dividend distribution of €0.12 per share compared to €0.09 the previous year in line with the annual increase in EPS.

All business activities contributed to the profitable growth of the Group: Yamaha sales (motorcycles & marine products in Greece, Romania, and Bulgaria) amounted to €75.8 million (+22.4%). Porsche sales amounted to €41.2 million (+50.1%). Sixt rental sales amounted to €41.4 million (+7.9%) and fleet sales at €12.5 million.

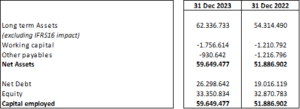

In 2023, the Group’s long-term assets amounted to €62.3 million (excluding the impact of IFRS 16), representing a 14.8% increase compared to 2022. The increase is mainly due to investments in our rental car fleet (Sixt) and a major investment in our Porsche Center Athens in Metamorfossi.

The net debt of the Group increased by €7.3 million to €26.3 million at the year’s end. Strong operating cash flows and ongoing financing agreements with the Greek Banks allowed the Group to finance the acquisition of the minority shares of Lion Rental S.A (€7.7 million) and expand the Sixt RaC fleet whilst maintaining the Net Debt/EBIDTA ratio at 0.9x.

The Chairman of the BoD and CEO, Mr. Paris Kyriacopoulos, stated:

“Motodynamics had an exceptional year, with significant growth in sales and profitability across all our activities. Following the record year of 2022, all our teams have set ambitious targets for 2023. Both in Yamaha and Porsche, sales grew at high double-digit rates: +22.4% and +50.1% respectively. This performance is due to the dynamic growth of the markets we operate in, the general stabilization of the supply chain, and specific actions that have led to market share gains. Car rental continues its significant upward trend of recent years, with incoming tourism showing exceptional performance and arrivals significantly exceeding those of 2019. The profitability of the activity returns to normality and remains very healthy. Car rental sales in 2023 increased by 7.9%, with more bookings but a slightly lower average price compared to 2022. The significant growth in fixed asset sales is a result of the team taking advantage of the favorable used car market and recording significant profitability through targeted actions. Following the completion of the acquisition of the minority rights in Lion Rental, we continue to invest in this activity based on our medium-term plan. We are monitoring the unstable geoeconomic and geopolitical environment and continue to invest in our strategy and markets. The team and partners of MOTODYNAMICS have laid the foundations for further profitable growth of the Group in the coming years.”

With regard to the announcement of the 2023 Financial Results, we are organizing an online Analysts’ Call on Thursday, March 21, 2024, at 16:00, via the Zoom webinar platform with the support of the Athens Stock Exchange. To register and participate, please follow the link: Analysts’ Call